As demand for poultry meat and eggs continues to rise, manufacturers of processing machinery are stepping up their game to provide farmers with the newest technology. By Michael Barker

With the tight margins of modern farming, everyone across the supply chain is seeking every possible opportunity to gain an edge. The ability to produce the highest-quality products as efficiently as possible and with the fewest rejects is king, and fortunately, the rapid evolution of technology is offering a welcome helping hand.

It means that poultry processing machinery is big business, and if the analysts are to be believed, there’s going to be plenty of new tech for farmers to get their hands on in the years ahead. According to a new report this summer by Precedence Research, the global poultry processing equipment market is projected to hit a whopping $7.7bn in value by 2034, representing a huge leap from the $4.45bn it reached in 2024. The growing production and consumption of poultry meat across the world – as the popularity of protein shows no sign of relenting – is credited as a key driver of market growth.

A further report, by Coherent Market Insights (CMI), notes that better awareness of the fact that poultry meat is a rich source of proteins, vitamins and minerals, is a major market driver. What’s more, the rise of ready-to-cook and ready-to-eat foods are gaining huge popularity, resulting in significant growth of processed chicken, nuggets, patties and other value-added products in both the retail and foodservice sectors. “All these factors have compelled poultry processors to focus on productivity and throughput with automated cutting-edge equipment,” the report states. “Advanced technologies allow high yields while maintaining food safety and quality standards. Moreover, automation helps overcome difficulties arising from labour shortages and wage inflation.”

From naturally or artificially flavoured chicken products such as barbecue wings or tandoori options, to breaded nuggets and tenders, precise marination, tumbling and massaging equipment is needed in addition to accurate and variable portioning tech. All of that has to be done with food safety and labelling regulations front of mind.

CMI says that one of the major opportunities for the poultry processing equipment market is the ongoing technological advancements in machinery and automated solutions. That is seeing manufacturers constantly innovating and developing newer generations of fully automated lines for the slaughtering, scalding, plucking, evisceration, de-feathering, chilling, cutting and de-boning of poultry. “Technologies such as robotics, artificial intelligence (AI) and Internet of Things are enabling the next stage of Industry 4.0 transformations in the sector,” it states.

AI takes centre stage

Artificial intelligence is the hottest of topics across almost every sphere of life in 2025, and the egg and poultry meat sectors are no different, as manufacturers bring a range of solutions to market that has the technology at its core.

One such example is Sanovo’s new Farm Intelligence Unit, which is an AI-powered system launched in October that is designed to transform how egg producers detect defects and manage flock health. Based on the logic that manual egg checks with the human eye cannot catch all the cracks, leaks or dirty egg shells early in the process, the Farm Intelligence Unit – which has a capacity of up to 72,000 eggs per hour – uses advanced vision technology and real-time data to uncover rejections earlier in the process. The approach sees every egg scanned and analysed automatically, with cracks, dirt, leakers and size variations detected early and before they reach the grader. That gives producers better control over flock health, product quality, and batch profitability, according to Sanovo, which highlighted other benefits as labour savings and cleaner packing lines.

AI vision systems are fast becoming a major feature of poultry processing sites, and are boosting efficiency across a wide range of functions. Meyn’s Multi Vision Quality Grading System for poultry features four camera tubes fitted with powerful, non-flashing LED lights for clear, detailed images. Together, the cameras provide a 360-degree view, offering superior defect detection accuracy while minimising false downgrades and manual rework. The system is able to detect defects including empty shackles, one-leg birds, broken wings, skin flaws, meat damage, burns, and bruises – even in hard-to-see areas like wing pits and groins.

Vision for the future

According to Baader, vision systems are an important component in the current digital transformation sweeping across the industry, with AI-driven systems bringing a new level of flexibility and precision, and enabling processors to make real-time decisions based on accurate, consistent data. “As companies embrace advanced technologies like automation, real-time analytics, and AI-enhanced vision systems, they are unlocking new levels of productivity, quality, and profitability,” says Michael Gillespie, global product manager for platforms, automation and software at Baader. “Digital solutions are no longer just a future consideration; they are a current driver of performance and competitive advantage.”

Gillespie notes that traditionally, vision systems have been used post-chilling to assess whole bird quality, offering valuable insights – but only at the very end of the process.

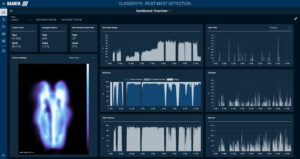

That is now changing, he says, with AI-powered vision systems like Baader’s ClassifEYE redefining what is possible, enabling real-time data capture and smarter, data-driven decisions throughout the entire production line.

ClassifEYE is designed to use AI to detect process anomalies and quality defects with consistent accuracy, and it works by first capturing high-resolution images at key locations, then using AI algorithms to analyse the images using pre-trained models and real-time data. The results are delivered instantly through intuitive dashboards, allowing staff to act fast.

The system is designed to be flexible and scalable as operations grow. “Any processor looking to enhance production control can start with a single computing unit and scale up to 24 cameras – either all at once or incrementally, depending on operational needs,” Gillespie says. “And of course, we ensure that all data is protected using robust, industry-standard security protocols, safeguarding operations from the factory floor to the cloud.”

New systems are now becoming available across the whole spectrum of poultry meat and eggs. In September, Moba launched a new Vision Weighing system for the unwashed egg market, combining AI and machine learning to determine egg weight with exceptional accuracy, and without contact and moving parts.

Moba says the absence of moving parts offers enhanced reliability, while the technology as a whole brings simplified cleaning and maintenance procedures, reduced dependency on manual labour, and high precision that directly boosts egg producers’ profit margins. The weighing system can upgrade Moba’s AI-based Vision Shell Inspector, which can spot cracks not visible to the human eye. “We are driven by the continuous urge from our customers to optimise and challenge the status quo,” said Luco Reitsema, senior product manager at Moba. “Our Vision Shell Inspector is transforming operations for egg producers, delivering unrivalled efficiency, food safety, and performance.”

Intelligent thinking

Intelligence is the buzzword for modern poultry processing machinery, with Marel pointing out that the ‘i’ in its Nuova-i and VC-i evisceration machinery stands for ‘intelligence’ – in other words, the process is about more than just a touchscreen on a machine. “It’s an internal ‘brain’ that ties together control, automatic adjustments, performance monitoring, connectivity, and system alerts,” the company says.

The manufacturer’s idea was to create an HMI (human-machine interface) that is straightforward to use and requires no more than half an hour’s instruction. The machine is backed by SmartBase software, and digital control means users simply choose ‘recipes’ which define the specific processes for a variety of flocks, with settings easily switched between flocks. For example, when concept chickens with longer legs come in, the recipe adapts height or guides accordingly. “Every operator knows what to do,” says product technologist Eva van der Velde. “When a heavy flock arrives, you simply select the right recipe on the touchscreen. The machine settings then adjust themselves. When light birds come in, you press the small-chicken icon to activate the corresponding settings; it is as simple as that. This works wonderfully, and performance stays incredibly stable.”

Across the sector, exciting new developments are set to continue apace. And producers will welcome every additional tool in their arsenal as they look to get ahead. It simply wouldn’t be intelligent not to.

Convenience drives egg processing market

Increasing demand for ready-to-eat and convenience foods is driving the growth of the egg processing market, offering opportunities for innovative producers.

That’s according to a 2025 report by The Business Research Company, which notes that the consumption of ready-to-eat and convenience foods has become more prevalent as convenience and time saving have gained importance.

The global egg processing market size is expected to see steady growth in the next few years, rising from a value of $29.3bn in 2024 to $34.9bn in 2029, the report states.

“The growth in the forecast period can be attributed to sustainable egg production practices, customised product solutions, government initiatives for nutrition, plant-based alternatives, and globalisation of food supply chains,” it states. “Major trends include technological integration in processing, advancements in packaging solutions, investment in research and development, collaborations in the food industry, online retail, and direct-to-consumer channels.”

With the likes of Noble Foods and Griffiths Family Foods making inroads into the value-added egg market in recent times, it’s no surprise that there’s expected to be greater demand for innovative egg processing machinery in the years ahead.