Poultry farmers outside the major quality assurance schemes say they feel “exposed, anxious, and hard done by” after being denied cover for Avian Influenza (AI) insurance, a move insurers say is essential to manage risk.

Several producers have voiced anger over being rejected for AI insurance because they are not members of assurance schemes such as the British Lion Code or Red Tractor. In one WhatsApp message shared among industry contacts, a farmer said: “You want to try and be a producer that’s been turned down for bird flu insurance because I’m not a member of some scheme like the Lion that would cost me a fortune.”

The sentiment reflects frustration among a minority of independent producers who are not members of assurance schemes, which cover roughly 90–95% of UK egg production.

According to Gary Ford of the British Free Range Egg Producers Association (BFREPA), underwriters such as Lloyd’s of London, which underwrites NFU Mutual’s insurance policy, have made scheme membership part of their acceptance criteria.

“The two schemes they recognise are the Lion Code and Red Tractor. The reason is both include independently audited biosecurity standards. That gives insurers the reassurance that the farm is operating to a minimum standard,” Ford explained. “This principle is common across insurers, much like car insurance companies that won’t accept drivers with certain convictions.”

This has left non-scheme producers, who may still run responsible and biosecure operations, feeling excluded. “Some of these farmers were formerly insured by Apollo, which has now withdrawn from the market. If NFU Mutual won’t insure them either, they have nowhere else to go,” said Ford. “We understand insurers have criteria, but it’s clear that some members feel vulnerable. We need another insurer in the market to provide competition and choice.”

Responding to the concerns, Adam Williams, Animal Disease Portfolio Manager at NFU Mutual, confirmed that quality assurance scheme membership is indeed one of the criteria for AI insurance acceptance. “The quality assurance schemes we recognise confirm the farmer’s compliance with independently audited biosecurity and business practices, which is essential for us to sustainably underwrite Avian Influenza insurance,” said Williams.

Despite lobbying by BFREPA to widen criteria, there is little hope that changes will be made in time for the upcoming season. “We have asked NFU Mutual to look again at the criteria, but it won’t be in time for this year,” Ford said.

For now, non-scheme farmers remain in a difficult position, with some calling the current options “a complete waste” and questioning whether the requirement for scheme membership unfairly penalises smaller, independent operators.

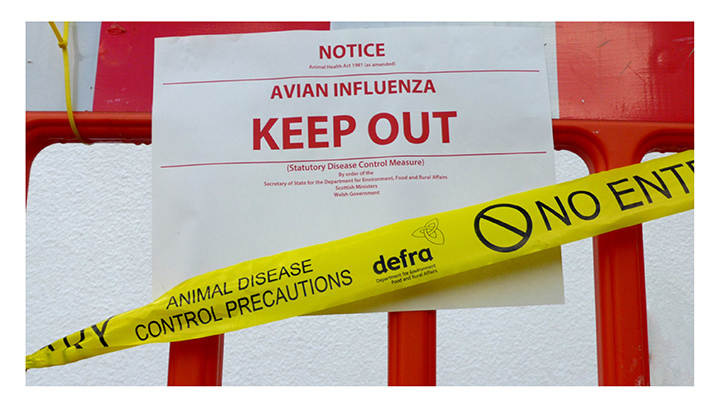

With five AI cases reported in June alone, the pressure to secure insurance before the season intensifies is mounting. The industry is now calling for greater flexibility, or ideally, a new player to enter the AI insurance market to offer alternatives for those currently left out.