The UK turkey industry is facing significant challenges. From competition with imported meat to evolving consumer habits and logistical hurdles post-Brexit, the sector is struggling. Yet there are also opportunities for innovation and renewed consumer relevance, and with a birthday on the horizon, there is a big marketing opportunity for turkey in 2026.

Kelly Turkeys hosted a conference at its Essex base in May with dozens of turkey farmers from across the country, in a day led by managing director Paul Kelly, examining these topics. The message was that although the UK turkey industry has declined, there is a sustainable future ahead, if the industry makes the most of the opportunities.

State of the market

In the mid-1990s, the UK produced around 46 million turkeys annually, Paul Kelly explained to the gathering of around 200 turkey farmers in a large storage unit on the farm in Danbury, Essex. Today, that figure has plummeted by 79% to just under 10 million birds. The number of UK turkey farmers has similarly shrunk to roughly 800, mostly small-scale operations averaging 1,500 birds each. This contraction reflects not only growing imports, especially breast meat “butterflies” from Poland and Germany, but also underinvestment in the UK.

Imported breast meat, sold often without clear origin labels, now dominates UK butchers’ counters at Christmas, Kelly explained. On average, 60% of turkey sold is imported, despite many consumers assuming what they are buying from butchers’ shops is British. The UK turkey sector is deeply linked to Christmas traditions but risks further decline without change. Projections warn of a 60% production drop in 20 years if current trends persist.

The UK is now Europe’s eighth largest turkey producer, Kelly explained. Poland and Russia dominate, each producing over 44 million birds.

Brexit has introduced logistical challenges, which has made life harder for British turkey businesses, he added, limiting live poult exports and shifting trade toward hatching eggs. The domestic poult market has halved from 150,000 to 80,000 birds annually.

Retail trends

Toby Kelly, who leads on new product development, delivered a presentation on retail trends.

The UK turkey market was worth £395 million in 2024, with Christmas driving 51% of annual revenue. This is expected to rise to £415 million in 2025 due to inflation and a shift from expensive beef to more affordable turkey.

Consumers often believe supermarkets are cheaper, but data reveals a more complex picture. Toby Kelly showed a range of prices from different UK retailers.

M&S wet-plucked: £21/kg

Waitrose dry-plucked: £17.50/kg

Tesco free-range: £10.50/kg

Aldi dry-plucked: £14.42/kg

KellyBronze premium: £15–£18/kg

Given these figures, premium British turkey is competitively priced, especially when production method and welfare standards are considered. The key is better communication of the value.

Crowns and joints are increasingly popular, particularly among smaller households and urban shoppers. Pre-seasoned and ready-to-roast options now represent 28% of sales, demonstrating that convenience and variety are driving growth.

Recent Kantar data shows that fresh turkey volumes declined by 0.2% over the past year, while frozen turkey sales grew, mainly thanks to discounters and price promotions.

Outside of Christmas, Toby made the case that retailers understock turkey compared to chicken. Ocado offers eight turkey SKUs versus 246 for chicken, and Sainsbury’s has 11 versus 83, he said. Yet innovative products like confit turkey thighs (Kelly has recently launched such a product under the Krafted by Kelly brand that is selling well) have proven there’s consumer appetite for variety.

Lessons from Abroad

Russia offers a powerful case study. There, turkey is positioned as a premium product with high nutritional value. This framing of turkey as a lean red meat substitute could have similar potential in the UK, where consumers are increasingly seeking healthy yet indulgent proteins.

However, changing British habits is not easy. The UK market is mature and saturated, with turkey still strongly associated with Christmas. To shift perception, the industry must invest in product development, brand repositioning, and customer education, Paul Kelly said.

Complementing whole birds with cut-up portions, joints, sausages, and prepared meals is the way forward, Kelly said. For example, jointed stag poults can generate £81 revenue per bird, with good gross margins. Skilled labour can portion birds efficiently.

These formats suit smaller households and busy lifestyles, while maintaining British provenance and quality.

500 Years of Turkey: A marketing opportunity

After a break to look around the farm’s processing facilities, the farmers heard once again from Paul Kelly, this time on how 2026 presents a brilliant marketing opportunity.

In 2026, the UK will mark 500 years since the turkey’s arrival in the UK. While initiatives like the NFU’s “Buy My Turkey” campaign are helpful, they are too seasonal and underfunded to shift perceptions year-round.

A solution could be a national, industry-funded campaign to reposition turkey.

Paul suggested there were lots of potential initiatives, including a national campaign: “500 Christmases, One Golden Centrepiece”; a “Turkey Walk” event around farms; collaborations with chefs and TV programmes; farm open days; and co-ordinated marketing efforts in butchers and retailers.

“If each Christmas bird sold contributed £1 toward marketing, the sector could raise £1–2 million to fund promotion,” he said.

About Kelly Turkeys

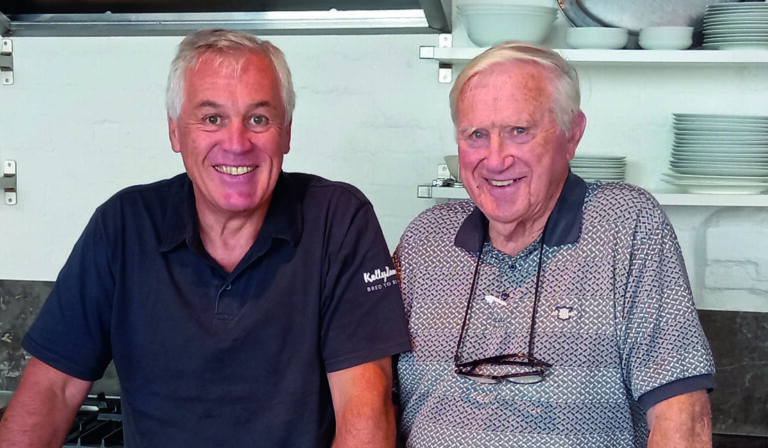

Kelly Turkeys was founded in 1971 by Derek Kelly, who is about to celebrate his 95th birthday. Managing 38,000 breeders and producing over 2 million eggs yearly, it supplies 27% of the fresh turkey market and hatches 150,000 eggs weekly across multiple sites. It also operates a farm in Virginia, USA.

Beyond breeding, the business has diversified into cooked and cured products, developing its own brands—Kelly Turkey Breeders, KellyBronze, Krafted by Kelly—and processes 155,000 turkeys annually. Premium dry-plucking methods are used on 42,000 birds during the Christmas peak.