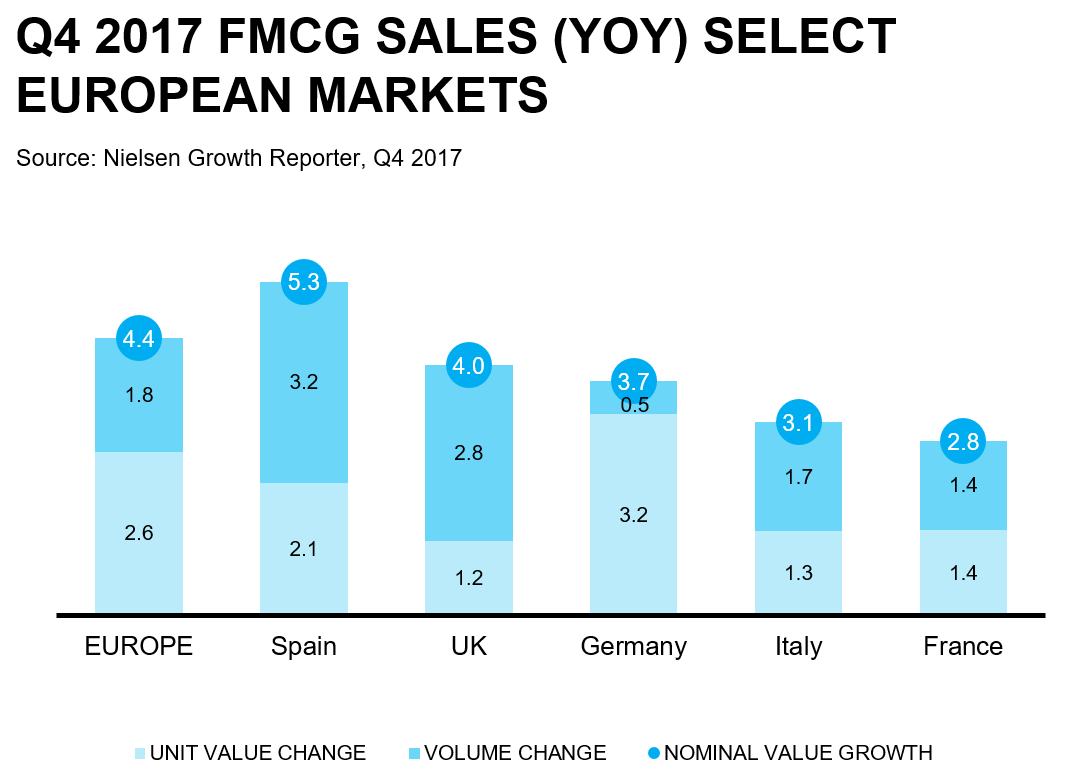

This 4.4% increase in takings at the tills – across the 21 European countries measured – was due to shoppers buying 1.8% more items and paying 2.6% more per item than they did a year ago. The higher prices were a combination of price inflation and shoppers actively choosing more expensive goods.

“After a few tough years, 2017 saw a dynamic economic environment across Europe with positive consumer confidence in the region and record highs in several countries,” said Olivier Deschamps, Senior Vice President Retailer Services Europe. “This contributed to a strong year for grocery retail, particularly impressive considering shoppers’ savings mindset such as looking for the best deals and a bigger preference for the discounters.

“One of the reasons for the growth against this backdrop is the performance of local brands over the leading international players. They’ve capitalised on the revival of “local pride”, tapping into consumer and retailer tastes towards premium, local champions, particularly the focus on health and wellness through organic and free-from ingredients. Health now being one of Europeans’ two biggest concerns.”

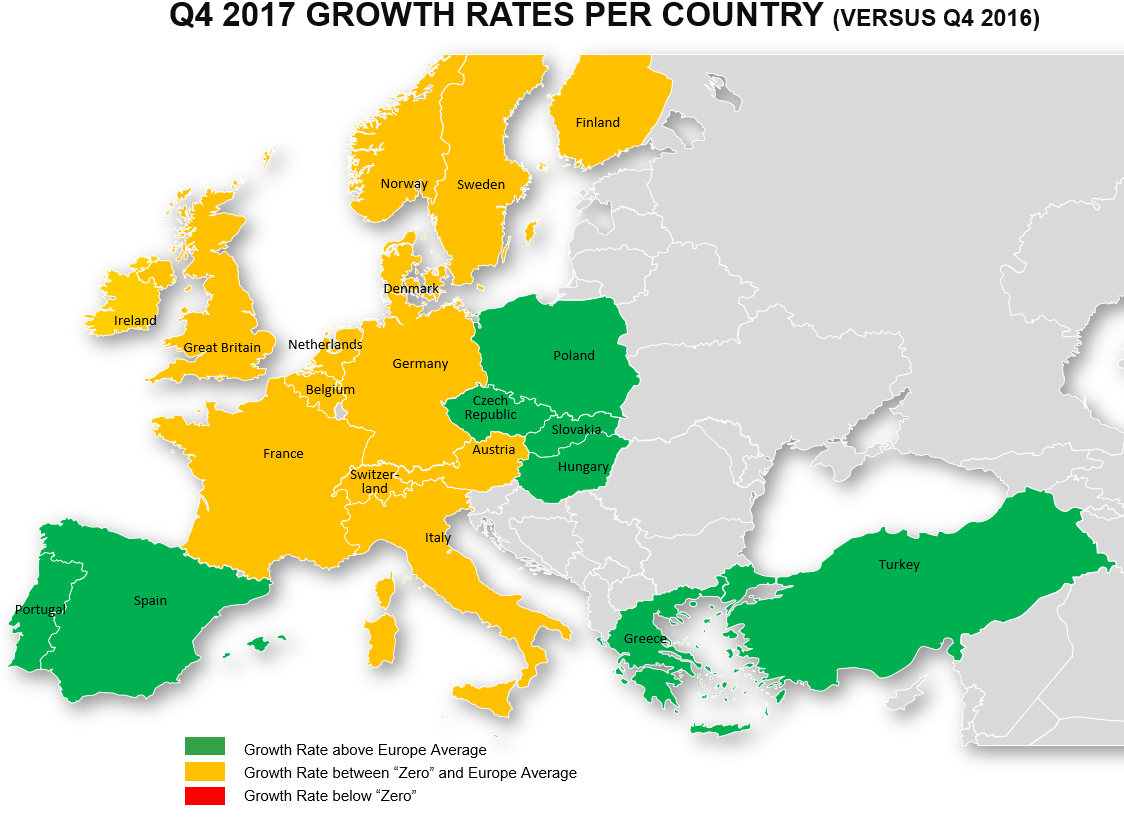

How different countries compare

Spain’s growth rate (+5.3%) was the highest among the big five western European markets, followed by the UK (+4.0%), whilst France had the lowest growth among this group (+2.8%).