Animal protein production growth will slow as margins remain tight in 2024, with producers and processors needing to adapt to sustain success, according to Rabobank’s annual global animal protein outlook report.

After four years of growth in animal protein production globally, the pace slow or even decline in 2024 across some species, the specialist food and agribusiness bank predicts.

The shift comes as producers and processors navigate tighter margins due to structural changes to market conditions. Higher production costs and tighter supplies will push animal protein prices up and constrain global consumption in 2024.

Input costs and inflation are likely to fall, but will remain at a higher level than pre-pandemic. There are also signs that consumers are growing used to higher prices and, in some markets, willing to pay a quality premium.

Some market changes appear to be permanent, Rabobank notes. Demographic shifts will see the labour market tighten and raise production costs, while reduced population growth will slow consumption.

Elsewhere, there will be pressure to invest in upgrading production systems to serve emerging market needs, meet regulatory requirements and cater to changing consumer preferences around sustainability. Adverse weather conditions and disease also present challenges.

Justin Sherrard, global strategist animal protein at Rabobank, said: “It’s a testament to the resilience and flexibility of companies along animal protein supply chains that they continue to grow production and deliver on customer expectations, amid such challenging market conditions. Despite a cost of living crisis putting pressure on consumer finances, there continues to be demand for animal protein, and companies have been able to overcome challenges, from high costs to regulatory uncertainty and disease, to capitalise on it.

“For companies to sustain the success of the past few years, it’s essential that they adapt to the structural changes in the market. Instead of simply riding out the storm, animal protein businesses need to take stock of their strengths and prepare to transition their supply chains to operating in an environment with high costs and tight margins.

“Companies should double-down on improving their productivity, review their existing portfolios, strengthen supply chain partnerships, increase investment in new product development and adjust their pricing strategies to navigate the challenges of the coming year.”

Rabobank’s analysts forecast marginal year-on-year production growth in the major markets of North America, Brazil, Europe, Oceania, China and Southeast Asia of 0.6 million tons – or 0.5% – to a total of 247 million tons next year. This is against a 2.1 million tons, or 1% growth, in 2023.

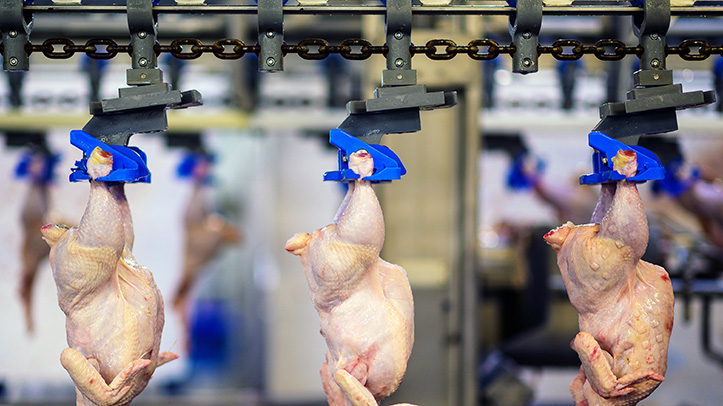

Poultry and aquaculture will be the only two species groups to see production grow in 2024, predicts Rabobank, though it will be slower than in 2023. Beef will continue the decline seen in 2023, moving with changes in cattle cycles in North America, while pork production will also contract modestly.

Justin Sherrard added: “Not all structural changes in the market are detrimental – many present new opportunities for businesses to improve their processes and products. Those companies that can demonstrate agility in adapting to the new environment and navigate consumer willingness to pay for certain preferences will be able to take advantage of the tighter market and come out on top.”